Pre tax profit margin calculator

The first input is the Buy price ie. The table below will automatically.

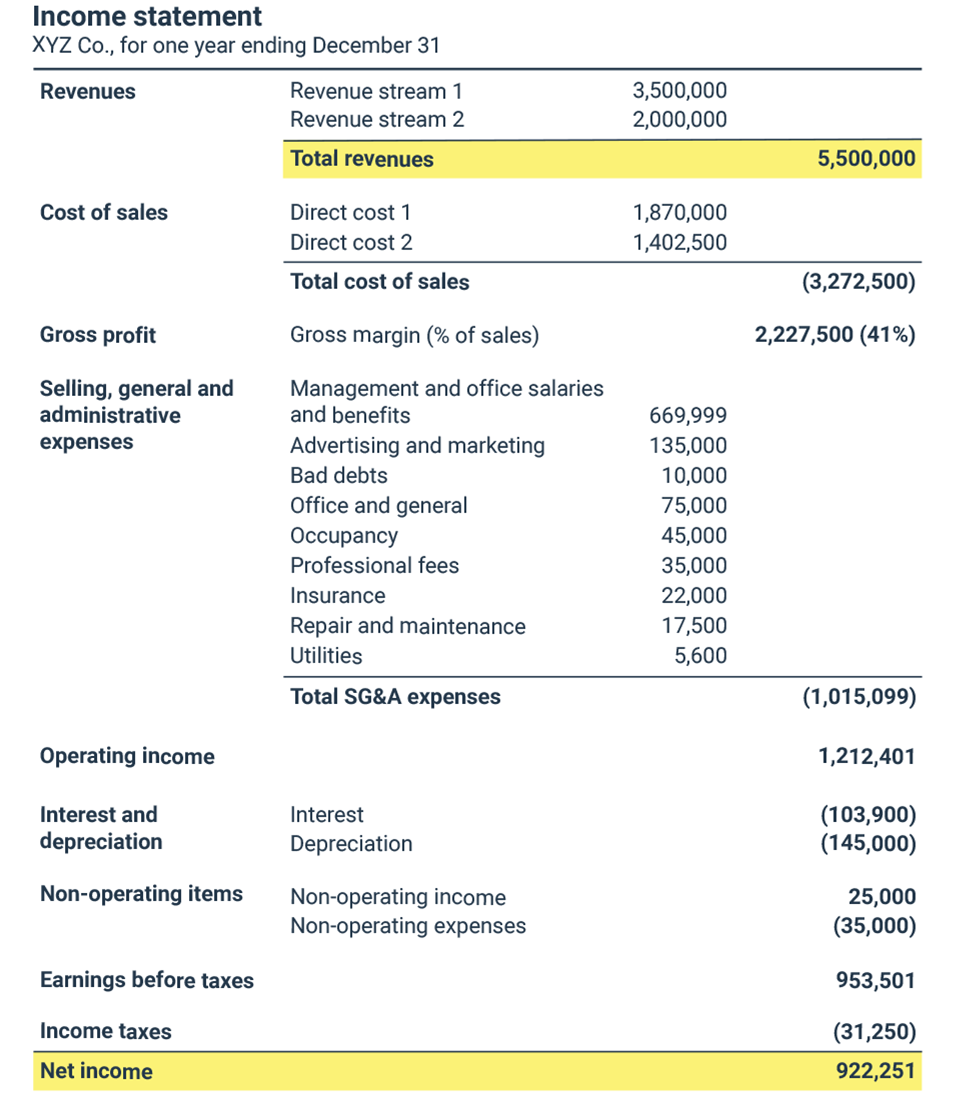

Net Profit Margin Formula And Ratio Calculator Excel Template

The total fixed costs are 50k and the contribution margin is the difference between the selling price per unit and the variable cost per unit.

. Cost of Debt Calculation Example 2 For the next section of our modeling exercise well calculate the cost of debt but in a more visually illustrative. To use the PAYE calculator enter your annual salary or the one you would like in the Insert Income box below. Present Value Therefore David is required to deposit 2462 today so that he can withdraw 3000 after 4 years.

Gross margin as a percentage of revenue increased to 444 percent in Q1FY23 against 406 percent in Q1FY22. Amount Pre-GST Amount under GST. The price at which the asset was bought second input is the sell price ie.

Eicher Motors Ltd on August 10 is likely to report a strong year-on-year improvement in its performance with its consolidated profit after tax PAT likely to increase by 152 percent. Alternatively the break-even point can also be calculated by dividing the fixed costs by the contribution margin. Pre-Tax Cost of Debt 28 x 2 56.

Our PAYE calculator shows you in seconds. After-Tax Cost of Debt 56 x 1 25 42. Zerodha FO margin Calculator part of our initiative Zerodha Margins is the first online tool in India that lets you.

So after deducting 1000 from 2000 the contribution margin comes out to 1000. Important - the calculator below uses the 2021-22 rates which is what you need to understand your tax obligations. Nifty is presently at 6100.

Wondering how much difference that pay rise or new job would make. 4 legs and is a limited risk non-directional option strategy designed for high probability of earning a small profit when you perceive low volatility. Margin Trading Facility MTF also known as eMargin is a product where you get funding from mStock for buying stocks in the share market.

There are 4 inputs you need to provide in order to commute the brokerage and profit or loss of the transaction using the brokerage calculator. The gross profit grew 54 percent YoY to Rs 5099 crore during the quarter ended FY23. Sell 1 OTM Put Short 1 lot of.

450 profit margin 9 base production cost 1350 product price We hope the key components in this product pricing guide help you move forward with your business idea. To arrive at the after-tax cost of debt we multiply the pre-tax cost of debt by 1 tax rate. Let us take another example of John who won a lottery and as per its terms he is eligible for yearly cash pay-out of 1000 for the next 4 years.

This facility is exclusively for delivery trades only. MStock offers up to 80 funding on more than 700 stocks with interest as low as 799 annually. Cost of the product 200000.

The price at which you choose to sell third input is the number of shares and last. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund. With an arsenal of information set your.

Net Profit Margin Calculator Bdc Ca

Pretax Profit Margin Formula Meaning Example And Interpretation

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Net Profit Margin Calculator Bdc Ca

Operating Profit Margin Formula Meaning Example And Interpretation

Operating Profit Margin Formula Calculator Excel Template

Pretax Profit Margin Formula Meaning Example And Interpretation

Gross Profit Margin Best Sale 58 Off Www Wtashows Com

Pretax Profit Margin Formula Meaning Example And Interpretation

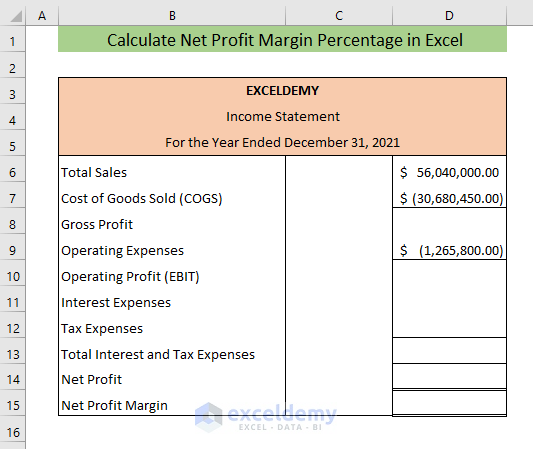

Net Profit Margin Formula And Ratio Calculator Excel Template

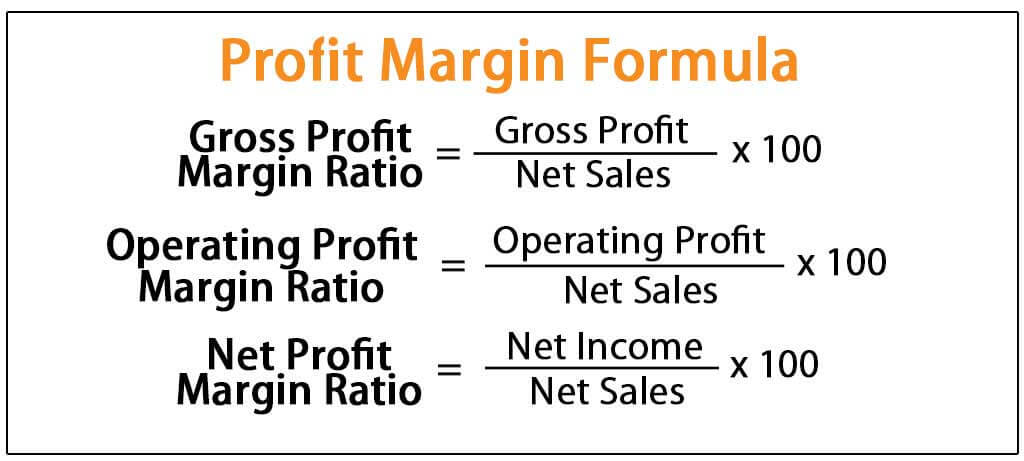

Profit Margin Formula And Ratio Calculator Excel Template

Profit Before Tax Formula Examples How To Calculate Pbt

Pretax Profit Margin Formula Meaning Example And Interpretation

How To Calculate Net Profit Margin Percentage In Excel Exceldemy

Guide To Profit Margin How To Calculate Profit Margins With Examples

Performance Profits How To Calculate Your Small Business S Margin Mila Lifestyle Accessories

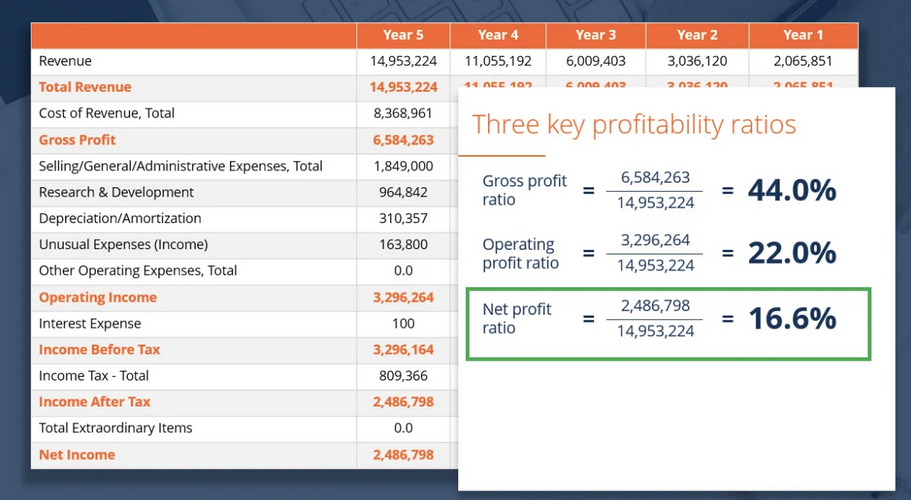

Profitability Ratios Accounting Play